ELIGIBILITY

Qualification Criteria

To qualify for the Affordable Homeownership Program, you must meet three criteria based on your information and documentation at the time of application. These are outlined at a high level below. Bear in mind that our guidelines for approving a loan are extensive and detailed; we encourage you to attend an information session where you can hear our criteria more comprehensively.

ONE: You demonstrate a need for affordable housing:

- Your gross annual household income falls below the 80th percentile of Chicago’s area median income, as defined by the Department of Housing and Urban Development annually.

TWO: You have the ability to repay a home loan. We determine this by evaluating your income/employment, credit, and savings to ensure you meet all of the following:

- Income: Your gross annual borrower income is equal to or above the 40th percentile of Chicago’s area median income for your household size.

- Income History: You demonstrate two years of employment or income history. This can include wage-based income, business income, and/or other income. Considerations may be made for shorter work histories in circumstances of a significant, documented life change.

- Credit: You have a credit score of 620 or higher; credit scores between 580-619 or invisible/no credit may be acceptable with alternate credit documentation.

- Debt: Your monthly Debt-to-Income (DTI) ratio does not exceed 43%.

- Credit History: You meet our guidelines for late payments and public records.

- Savings: You have a minimum of $2,500 in savings with the ability to save an additional $2,000 prior to closing on your home. Please note, we will evaluate whether you have maintained the minimum of $2,500 in a bank account for the most recent two months leading up to your application.

THREE: You are willing to partner in our program by:

- Choosing to live in one of the neighborhoods where Habitat Chicago builds its homes. We build homes in the Austin, West Pullman, and Greater Grand Crossing (learn about our homes for sale here).

- Completing 200-250 partner hours over the span of 8-14 months.

- Attending free, approximately monthly, homebuyer education classes and support meetings.

INELIGIBLE: You may not be eligible if you:

- Are a current homeowner.

- Have any recent judgments.

- Have been in bankruptcy in the past two years, or foreclosure in the past three years.

- Are a registered sex offender for serious violations.

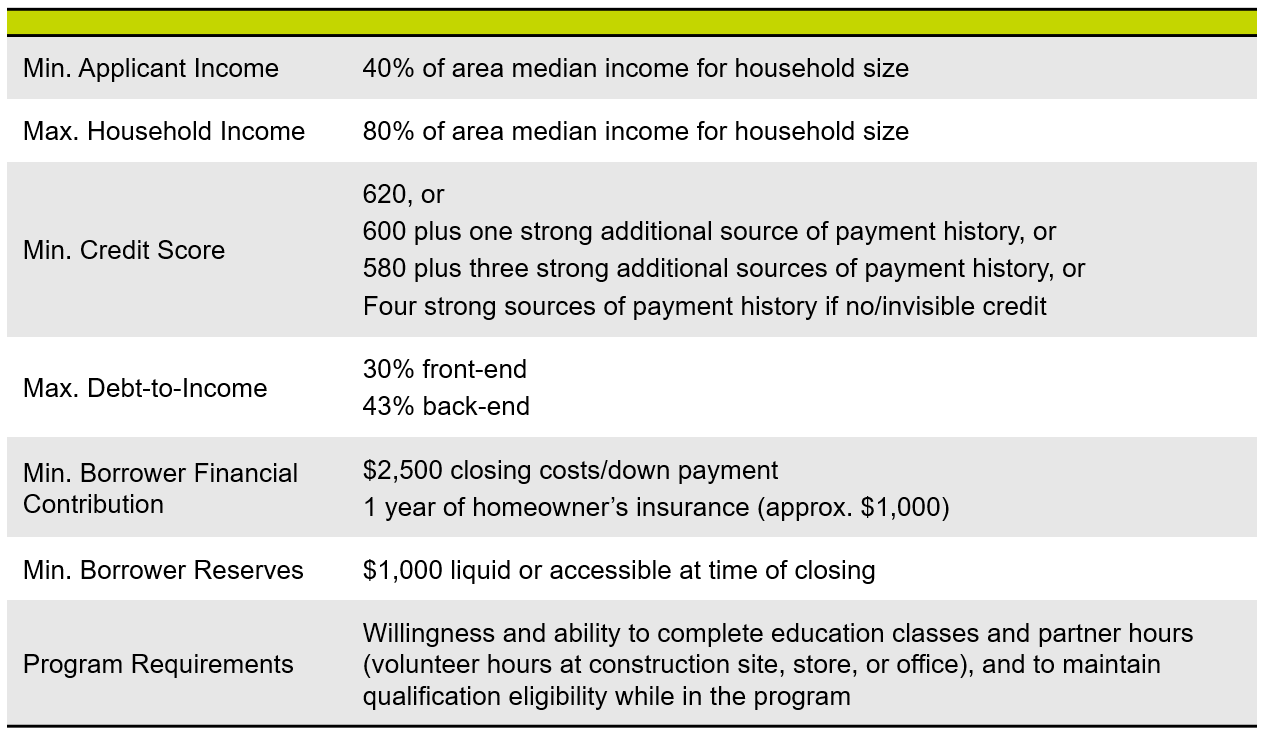

Summary of Qualifications

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Qualification Self- Assessment

We encourage anyone interested in the Affordable Homeownership Program to apply. Before you do, however, we recommend that you take our short self-assessment to get a sense of your eligibility readiness. This is a great first step to get in touch with us about your eligibility.

Please note: Completing this assessment is not the same as applying to our program. We do not ask for names, contact information or any other information that could identify you individually in the assessment form and we do not receive your results; it is meant only for your own use and insight. To learn how to apply, follow our Next Steps below.

Next Steps

Ready to learn more? Here are some next steps you can take:

- Read the next page in the sequence: 6. Application Instructions

- Subscribe to receive email updates and reminders about the Affordable Homeownership Program

- Register for and attend an information session where you can hear directly from our team and ask any questions you may have

Think you may have some work to do?

If you’ve determined, after reading this page and/or taking our self-assessment, that you have a few things to figure out before applying, here are some resources to get you started:

1) Set up an appointment with a HUD-certified housing counselor. A HUD counselor is completely free to work with, and they can help you see your credit report, create debt, credit and savings strategies, and help you understand loan criteria when applied to your situation specifically. Please visit the Service Resources Directory on our website for a list of organizations that can help connect you with one of these counselors.

2) You may also consider enrolling in our public home loan preparation course, Homebuyer University, where professionals in the lending world go over the ins and outs of loan readiness. Please note that Homebuyer University is separate from the Affordable Homeownership Program; enrollment in one does not impact the other.