AFFORDABLE HOMEOWNERSHIP PROGRAM OVERVIEW

Habitat Chicago typically builds and sells 8-15 homes per year with homes located in the Austin, West Pullman, or Greater Grand Crossing neighborhoods on Chicago’s South and West Sides. In order to purchase a home from us, you must apply, meet all qualification criteria, and be willing to partner with us for the duration of the program. We accept applications year-round until all available housing units are sold.

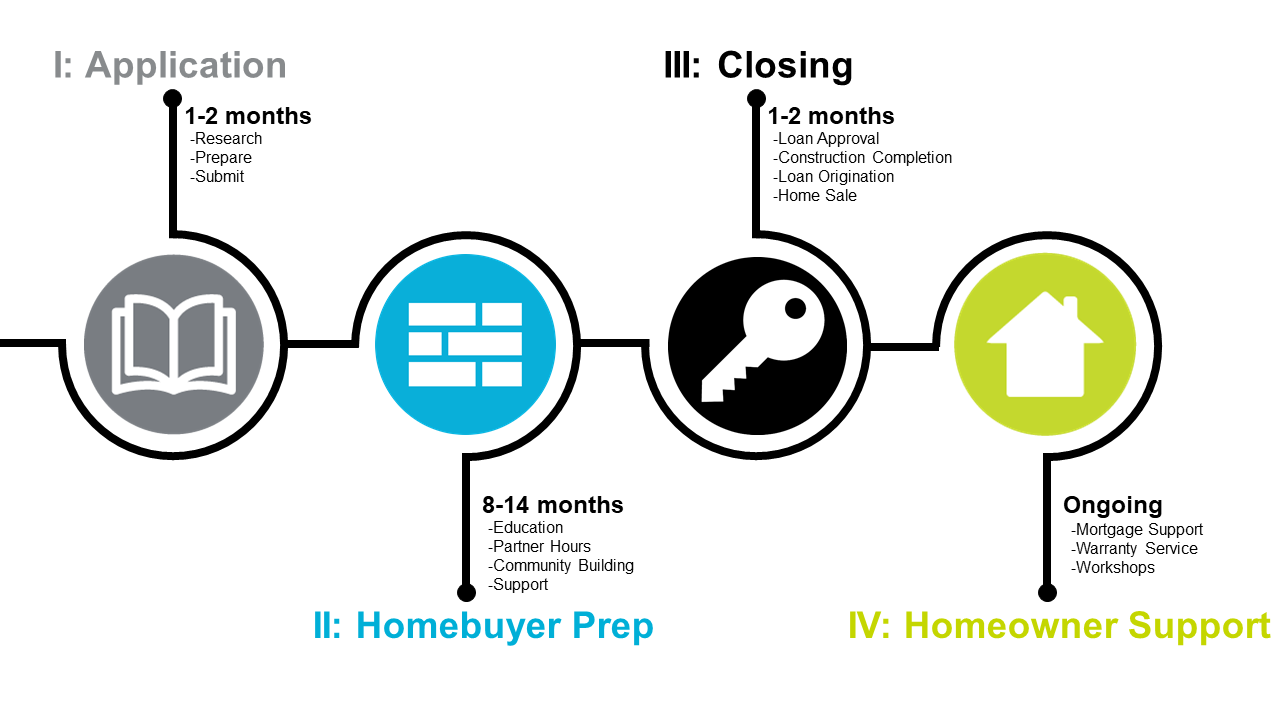

Outlined below are the four distinct phases to the Affordable Homeownership Program, Habitat Chicago’s first-time homebuyer program.

Phase I: Application

The Application phase refers to the period you spend preparing for and submitting your application and includes the following:

Research: It is important you feel confident that this program is a good fit for you. You can access all information about the program here on the website, but we also encourage you to learn more by attending one of our regularly scheduled information sessions where we go over the program in greater detail and provide opportunities for questions. You may also consider volunteering on one of our build sites to get to know the types of houses we build and the neighborhoods in which we build.

Prepare: The program application, like any home loan application, requires a great deal of financial documentation that may take you some time to gather. Take your time in doing so to ensure your application is accurate and complete.

- Depending on your financial readiness, you may consider working with a HUD-certified credit counselor to improve your position and strengthen your application.

- You may also consider enrolling in our public home loan preparation course, Homebuyer University, where professionals in the lending world go over the ins and outs of loan readiness. Please note that Homebuyer University is separate from the Affordable Homeownership Program; enrollment in one does not impact the other.

Submit: When ready, gather all required documentation, complete the application, and schedule a consultation to submit the assembled packet. Once you submit your application, we review the information to determine eligibility for your loan pre-approval and program acceptance.

Timeline: Depending on your personal loan readiness, preparing for your application may take you anywhere from one month (if you simply need to gather documents) to over a year (if you want to work on some eligibility factors). Once you submit a complete application packet, we take approximately 30 days to process, review, and make an approval decision. We are always available to you as a resource for questions and guidance as you work through this phase.

Phase II: Homebuyer Preparation

The Homebuyer Preparation phase refers to the period between your application approval and your purchase of the house. As an approved applicant, you can look forward to the following:

Education: We provide education classes and workshops designed specifically for your success as a homeowner. We cover such topics as financial management, home maintenance, civic engagement, and homeowner success, with courses offered through a mix of in-person and virtual delivery. Participation is required.

Partner Hours: You invest a minimum of 200 partner hours while in the program. The hours can be completed by volunteering on our build sites, at our ReStore, or in our office. You also earn partner hours for time spent in class and in support meetings. At least 100 hours must be completed on a build site.

Community Building: Homeownership is a long-term investment. We want you to be invested in your community as much as you are in your home. You will have opportunities to meet other Habitat Chicago homebuyers and homeowners, as well as other neighborhood residents, so you know you have people to lean on in your transition to and throughout homeownership.

Support: The process of preparing for, building, and buying a house can feel overwhelming at times. We will meet with you regularly to make sure you are moving through the program well, meeting all target deadlines, maintaining your eligibility, and feeling confident in your progress along the way.

Timeline: Phase II can take you anywhere between eight and 14 months, depending on the timing of your application and the subsequent completion of all requirements. During this time, we walk closely with you, providing opportunities for learning and support to ensure success.

Phase III: Closing

The Closing phase refers to the period leading up to the official sale of the home and includes:

Final Loan Approval: Your original application for and acceptance into the program (Phase I) is a pre-qualification for our loan. Once you near the end of the program and are about to purchase your home, we work with you to submit a final application, through which we can ensure that you still meet all qualification requirements for your loan. At this time, we also calculate your loan affordability and determine your maximum housing payment.

Construction Completion: Once we complete your home and facilitate necessary inspections, we order an appraisal to determine the value of the home and set the sale price. You conduct a final walk-through to confirm the quality of the home. You must also secure a homeowner’s insurance policy at this time.

Loan Origination: Once we have the appraisal and sale price for your house, we prepare your final loan documentation. Additionally, we assist you with applications for down payment assistance if available at the time.

Home Sale: Following the approval of any down payment assistance, we finalize your loan documentation and schedule your closing. This is when you take on official ownership of your new home!

Timeline: The Closing phase can take you between six and 10 weeks. During this period, we work closely with you to ensure all of your documentation and applications are accurate, complete, and submitted appropriately.

Phase IV: Homeownership Support

The Homeownership Support phase refers to the period following the sale of your home and lasts for the duration of your ownership. It includes the following:

Mortgage Support: Following the closing, you will be responsible for making on-time, monthly payments of your mortgage. We work with another party to collect those payments, but we will continue to hold the mortgage as the lender and be available to you for questions and support for the life of your loan.

Warranty Service: Your new home purchase includes a one-year limited warranty. Over the course of that year, if you discover a defect in the construction of the house or in its mechanical equipment, you can submit a warranty request to us for review and potential repair.

Workshops: We offer workshops that support you in your homeownership success, covering topics such as property tax appeals and exemptions, estate planning, and home maintenance. Your participation is completely voluntary.

Timeline: Phase IV can continue for as long as you occupy your Habitat Chicago home. During this time, we are available as a resource to answer questions and connect you to the parties that can best meet your homeownership needs.

Program Timeline

Each applicant’s timeline of entry into the program through to closing may look different depending on application readiness and timing, construction progress, down payment assistance availability, and buyer final qualifications. The timeline below provides a general overview.

Next Steps

Ready to learn more? Here are some next steps you can take:

- Read the next page in the sequence: 3. Homes for Sale

- Subscribe to receive email updates and reminders about the Affordable Homeownership Program

- Register for and attend an information session where you can hear directly from our team and ask any questions you may have